Understanding the Gap Ratio !

Understanding the Gap Ratio !

The Gap Ratio is a calculation that measures the difference between monthly and weekly high and low numbers. It is calculated by subtracting the weekly low from the weekly high and dividing by the monthly high minus the monthly low. This provides an indication of how much of the monthly range has been covered by the weekly range. The Gap Ratio oscillates between 0 and 100, where 0 indicates no gap between the monthly and weekly high lows, and 100 indicates a complete gap.

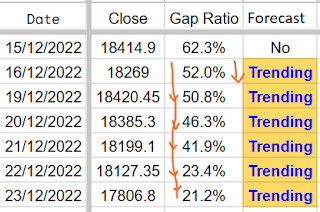

Live Gap Ratio...

A Gap Ratio of 30% means that the weekly movement has

covered 70% of the monthly movement, leaving a mere 30% opportunity for the stock to

achieve further movement. It's important to note that the Gap Ratio alone does

not provide a complete picture of the market trend.

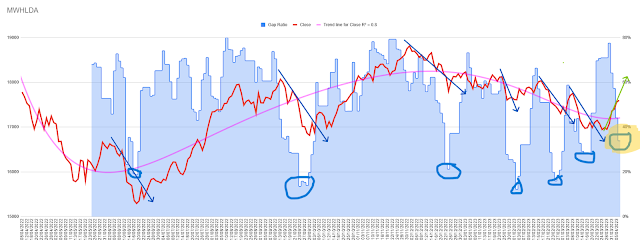

If the Gap Ratio is decreasing in a linear form, it may

indicate short-term trends. However, it's important to consider other factors

that may be influencing the market trend, such as technical breakouts,

fundamental analysis and market news.

To create a benchmark for potential reversals, you can take the

mean and standard deviation of the daily Gap Ratio over a one-year dynamic time

frame. By dividing the Gap Ratio by the mean, you can calculate the probability

of the trend continuing. This probability can be compared to the standard

deviation of the Gap Ratio to identify potential reversal points. It's

important to note that statistical analysis should be used in conjunction with

other forms of analysis and should be continually monitored to account for

changing market conditions.

Check the Gap Ratio is decreasing with the increasing of Nifty index.

Gap Ratio chart with nifty index.

0 Comments: